Fake Business Tax Id Number

2024-04-21 2024-04-21 9:07Fake Business Tax Id Number

Fake Business Tax Id Number

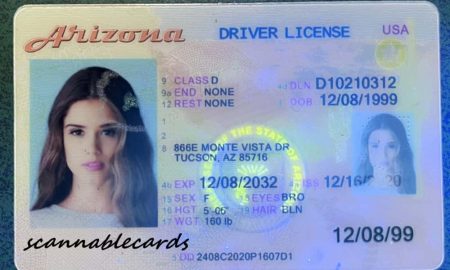

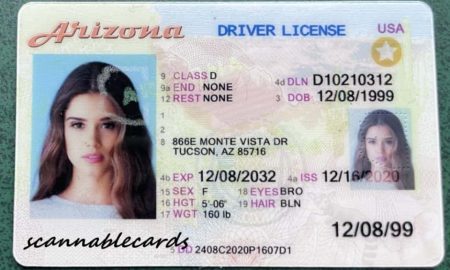

Arizona Fake Id

Czech Republic Id Card Fake Scannable

France Passport Fake

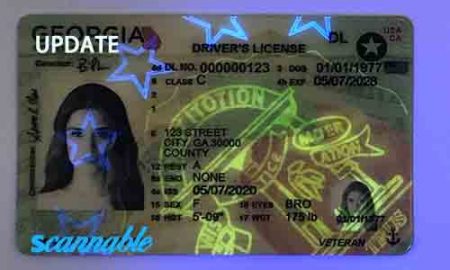

Georgia Fake Id

A fake business tax ID number can land you in hot water with the IRS and other government agencies. This deception can result in heavy penalties, fines, or even criminal charges. It is essential for businesses to operate within the law and obtain a legitimate tax ID number to avoid any legal ramifications.

The Internal Revenue Service (IRS) requires businesses to have a tax ID number for tax filing purposes. This number is used to track a company’s income, expenses, and overall financial activity. Without a valid tax ID number, a business cannot file taxes or conduct various financial transactions.

The use of a fake business tax ID number is illegal and can result in serious consequences. The IRS has stringent laws and penalties in place for businesses that attempt to deceive the agency. If caught using a fake tax ID number, a business may face hefty fines, penalties, or even criminal charges.

Business owners should never attempt to use a fake tax ID number to save on taxes or avoid reporting income. The consequences of using a fake tax ID number far outweigh any potential benefits. It is essential for businesses to comply with IRS regulations and operate within the confines of the law.

In addition to facing legal consequences, businesses that use fake tax ID numbers may also damage their reputation and credibility. Customers and partners may question the legitimacy of a business that engages in deceptive practices. This can harm relationships with clients, suppliers, and other stakeholders.

Business owners should take the necessary steps to obtain a legitimate tax ID number for their business. The process of obtaining a tax ID number is simple and straightforward. Businesses can apply for a tax ID number online through the IRS website or by submitting a paper application.

It is crucial for business owners to understand the importance of compliance with IRS regulations and the severe consequences of using a fake tax ID number. Operating with integrity and honesty is paramount for the success and longevity of a business.

In conclusion, using a fake business tax ID number is illegal and can have severe consequences. Business owners should always ensure they have a valid tax ID number and comply with IRS regulations to avoid penalties, fines, and criminal charges. It is essential for businesses to operate within the law and maintain their credibility and reputation with clients, suppliers, and other stakeholders.