Fake Tax Id Number Us Generator

2024-04-29 2024-04-29 7:40Fake Tax Id Number Us Generator

Fake Tax Id Number Us Generator

Estonia Id Card Fake Scannable

Ohio Drivers License Fake Scannable

Ontario Fake Id

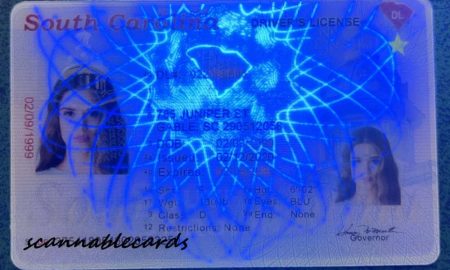

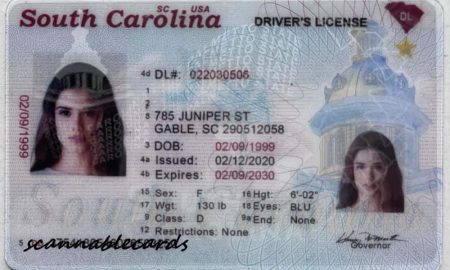

South Carolina Fake Id

In today’s technological age, it has become increasingly easier for individuals to obtain fake tax identification numbers. These fake IDs can be used for a variety of illegal activities and pose a significant threat to the integrity of the tax system.

The proliferation of fake tax ID number generators in the United States has become a growing concern for both taxpayers and the Internal Revenue Service (IRS). These fake ID numbers are often used by individuals seeking to evade taxes, commit identity theft, or engage in other fraudulent activities.

One of the most common uses of fake tax ID numbers is to file false tax returns in order to obtain refunds to which the individual is not entitled. By using a fake tax ID number, individuals can avoid detection by the IRS and collect refunds based on false information. This type of fraud not only costs the government billions of dollars each year but also puts legitimate taxpayers at risk of audits and penalties.

Another common use of fake tax ID numbers is to open bank accounts, apply for credit cards, or obtain loans under false pretenses. By using a fake tax ID number, individuals can assume the identity of others and engage in financial transactions that can have serious consequences for the victim.

In addition to financial fraud, fake tax ID numbers can also be used to commit other types of crimes, such as money laundering, drug trafficking, or terrorism. By obtaining a fake tax ID number, individuals can hide their true identities and engage in illegal activities without fear of being caught by law enforcement.

The availability of fake tax ID number generators online has made it easier than ever for individuals to obtain these fraudulent documents. With just a few clicks of a mouse, anyone can generate a fake tax ID number that looks legitimate and can be used to perpetrate a wide range of crimes.

To combat the proliferation of fake tax ID numbers, the IRS has implemented a number of security measures to detect and prevent fraud. These measures include increasing the use of biometric technology, improving data matching systems, and conducting more thorough background checks on taxpayers.

However, despite these efforts, fake tax ID numbers continue to pose a significant threat to the integrity of the tax system. In order to protect themselves from falling victim to tax fraud, taxpayers should be vigilant in safeguarding their personal information and reporting any suspicious activity to the IRS.

In conclusion, the use of fake tax ID numbers in the United States is a serious problem that poses a threat to the integrity of the tax system. By generating fake tax ID numbers, individuals are able to commit a wide range of crimes, from financial fraud to terrorism. It is important for taxpayers to be aware of this threat and take steps to protect themselves from falling victim to tax fraud.